iowa lottery tax calculator

495 Indiana 34 Iowa 5. The calculator will display the taxes owed and the net jackpot what you take home after taxes.

Top 5 Best And Worst States To Win The Lottery

The Michigan Lottery added Mega Millions in 2002 Fantasy 5 in 2004 and Lotto 47 in 2005 For most winners they will get a refund because.

. A federal tax of 24 percent will be taken from all prizes above 5000 including the jackpot before you receive your prize money. The Iowa Lottery does not withhold tax for prizes of 600 or less. 495 Indiana 34 Iowa 5.

Annuity-based lottery payouts work the same way as common immediate annuities. The Tax Calculator helps you to work out how much cash you will receive on your Lotto America prize once federal and state taxes have been deducted. IRS takes most of the winnings.

Current Mega Millions Jackpot. By law prizes of more than 600 will face a 5 percent state withholding tax. This also applies to winnings from a multi-state lottery if the tickets were purchased within the state of Iowa.

Before the money reached the last winner the bounty was subjected to a 24 percent federal tax on gambling winnings as US tax residents. This can range from 24 to 37 of your winnings. This varies across states and can range from 0 to more than 8.

Iowa Income Tax Calculator - SmartAsset REV-573 -- Property Tax Rent Rebate. Probably much less than you think. Lottery taxes are anything but simple the exact amount you have to pay depends on the size of the jackpot.

Calculate your lottery lump sum or. The Iowa tax that must be withheld is computed and. The initial state withholding taxes are based on published guidance from each state lottery and the final state tax rates are from state government publications.

All calculated figures are based on a sole prize winner and factor in an initial 24 federal tax withholding. Iowa Lottery Tax Calculator. More specifically lottery annuity payments are a form of structured settlement.

This tool helps you calculate the exact amount. The Iowa Lottery makes every effort to ensure the accuracy of the winning numbers prize payouts and other information posted on the Iowa Lottery website. If a player wins more than 5000 an.

This is equal to a percentage of Iowa taxes paid with rates ranging from. Calculate the taxes you need to pay if you win the current Powerball jackpot and more importantly how much money you will take home. Tuesday Nov 08 2022.

A lottery payout calculator can also calculate how much tax youll pay on your lottery winnings using current tax laws in each state. File returns and make payments Four Iowa Lottery players so far have won the games prize of 25000 a year. You may then be eligible for a refund or have to pay more.

2 days agoThe jackpot for Saturday nights drawing is now the largest lottery prize ever at an estimated 16 billion pretax if you were to opt to take your windfall as an annuity spread. After determining their Iowa state tax liability many Iowa taxpayers must pay a school district surtax. Additional tax withheld dependent on the state.

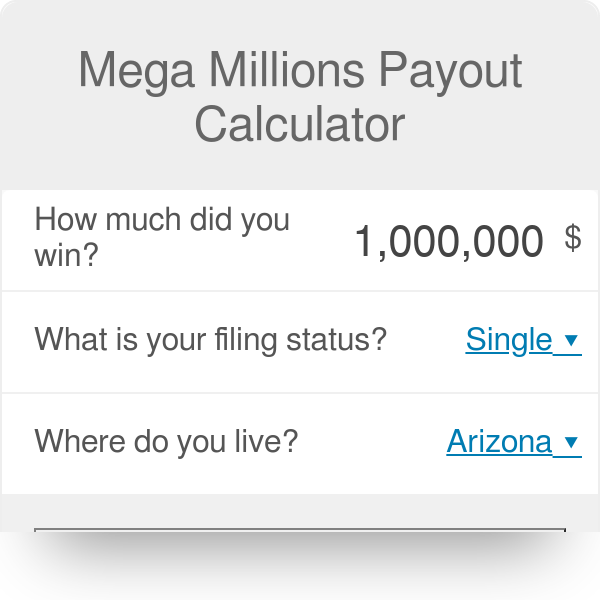

Our Mega Millions calculator takes into account the federal and state tax rates and calculates payouts for both lump-sum cash and annual payment options so you can compare the two. The Iowa Lottery makes every effort to ensure the accuracy of the winning numbers prize payouts and other information posted on the Iowa Lottery website.

Comparethelotto Usa Lottery Odds Calculators Results And More

Do You Pay Taxes On Powerball Jackpots H R Block

Lottery Calculators Calculate Taxes Payouts Winning Odds

Mega Millions Payout Calculator

Usa Lottery Tax Calculators Comparethelotto Com

Lotto America Tax Calculator Calculate The Lottery Tax

Usa Lottery Tax Calculators Comparethelotto Com

:max_bytes(150000):strip_icc()/GettyImages-1170519309-a2fdc4e4d5b7453b9caeef8c56e8dbdb.jpg)

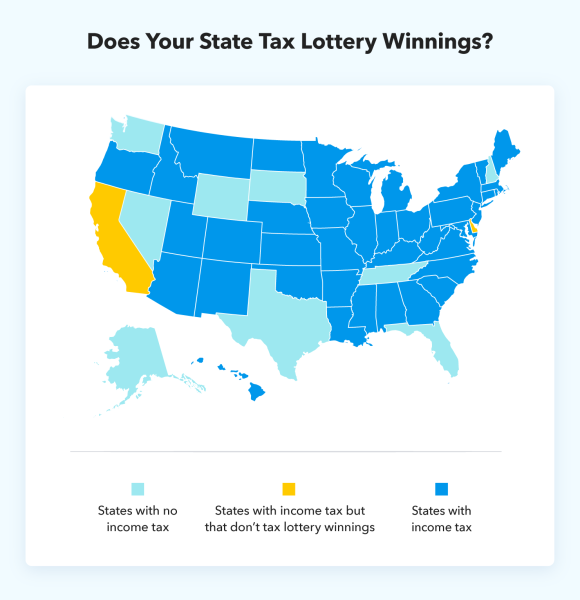

The Best And Worst States To Pay Taxes On Lottery Winnings

The Best And Worst States For Winners Of The Billion Dollar Powerball Lottery

Lottery Calculator The Turbotax Blog

New Jersey Sales Tax Calculator And Local Rates 2021 Wise

Lotto America Tax Calculator Calculate The Lottery Tax

Lottery Calculator The Turbotax Blog

Tennessee 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Know How Much Taxes You Will Pay After Winning The Lottery

Powerball Jackpot How Much Winners Pay In Taxes By State Money